Program Overview

Poor financial management in the public sector has for years been highlighted by role players in the financial sector such as the Minister of Finance, the chairperson of SCOPA and the Auditor General.

The quality of financial statements, lack of understanding of basic internal controls, ineffective internal audit departments and the limited knowledge of accounting and financial principles are only some of the matters, which contribute to poor financial management practices.

This qualification is aimed at addressing the need for transformation through training; to enhance the skills and competencies of government accounting staff that in turn will contribute to the efficiency and productivity of government.

If you want to work in finance in government or municipalities, this is the programme to study.

It’s been designed to address the lack of skills in the public sector and give students knowledge that will help government run more productively. You’ll learn how to produce high quality financial statements, implement basic internal controls, conduct effective internal auditing, and apply sound accounting and financial principles.

The intention of this qualification is to:

- To provide learners with the knowledge, understanding, skills and application techniques that they need to be successful in their work as qualified accounts administrators in the public sector.

- To allow learners to study in the way that best suit their learning style and time by means of institutional and workplace learning.

- To allow learners the opportunities for growth and development leading to the transformation of currently poor financial management practices in the public sector.

- To provide the employer with lifelong learners who are confident and independent, literate, numerate and multi-skilled, compassionate, with a respect for the environment and the ability to participate in their work as critical and active employees.

- Provide the public sector with professionally qualified, skilled staff, which is able to make a positive contribution to improving public finance, adding value and contributing to the efficiency and productivity of the government of South Africa.

Why study with us?

We provide high quality academic trainings that will enable you to get qualified in your chosen field; you will also be provided with a solid foundation to help you build your career or business. We’ll help you achieve your ambitions no matter how big they are and at the same time open your mind to possibilities you didn’t even know existed. Our standards are very high yet, we are easily accessible and affordable to everyone irrespective of their socio-economic background.

Entry Requirements

- Grade 12 – Matric,

- A senior certificate or

- National Certificate (N3) or a relevant Nated equivalent qualification

- International students with Senior School Certificate can apply.

Program Modules

- Bookkeeping to Trial Balance (BKTB)

- Public Accounting Administration (PAAD)

- Computerised Bookkeeping (CPBK)

- Business Literacy (BUSL)

- Financial Statements (FNST)

- Cost and Management Accounting (CMGT)

- Technical Public Accounting (TPAC)

- Business Law and Accounting Control (BLAC)

- Corporate Strategy (CRPS)

- Management Accounting and Control Systems (MACS)

- Financial Reporting and Regulatory Frameworks (FRRF)Research Theory and Practice (by short dissertation; topic: Public Accounting) (RTAP)

Internship Requirement

This programme requires that the student undertakes an internship for a minimum of 12 months in relevant industry after completing the in-class academic study. There is an opportunity for job placement assistance through our industry network after graduating depending on availability.

Qualification Obtainable

On completion of the program, student will receive a certificate for each level completed and subsequently a Diploma in Public Sector Accounting. Certificates and Diplomas are awarded by the Institute of Certified Bookkeepers (ICB).

Program Accreditation Information

Institute of Certified Bookkeepers (ICB) accreditation No: 300998

Department of Higher Education and Training accreditation No: 2019/FE07/011

Duration, Study Mode & Intake Dates

Full Time

- Study Duration: 36 months

- Admission dates: Throughout the year

Online & Part Time

- Duration: 36 months

- Admission dates: Throughout the year

Career Opportunities

- Public accounts administrator

• Technical public accountant

• Financial accountant

• Public sector budgeting officer

• Public sector auditor

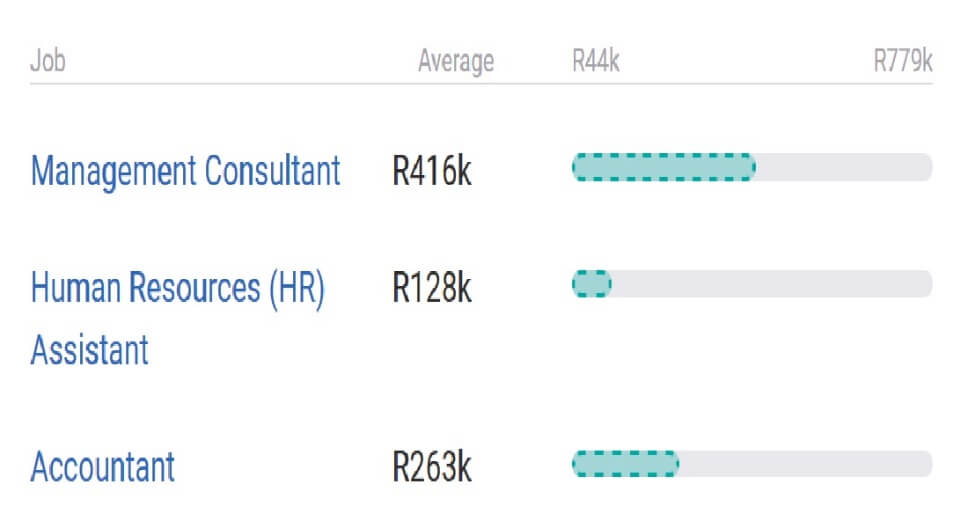

Related Industry Salary for graduates of Public Sector Accounting